Setting up a Drone Business?

These days everyone has a commercial drone delivery idea. I mean, it makes sense to the casual observer. Small, electric unmanned delivery drones replacing cars, trucks, or even helicopters.

It’s a no-brainer. Right?

There is a thing in the drone business called the 3D’s. Dangerous, Dirty, or Dull. It’s a clever way of describing where drones could fit into daily work.

We’d like to offer our own 3D’s. The Drone Delivery Dilemma.

Drone Excitment

Professional Drones have taken a back seat of late, eclipsed by grander issues within UTM (UAS Traffic Management). But also due to the rise of e-VTOL and electric aircraft, bullish Aviation investors scramble to balance their portfolios with some “Green” assets.

But with many of these vehicles barely at the pre-prototype stage, there’s a long way to go before we will know if they will even fly, much less be of commercial value.

Drones can save you money compared to other vehicles. But can you make money from them? Is owning multiple delivery drones a wise business decision?

Commercial Vehicles

Let’s look at the Drone delivery market, which in truth, has been around for a while. And let’s analyze whether money can be made at the investor or commercial operator level.

What we mean by investor/operator, is not the OEMs or the end customer, but an entity seeking to operate drones for hire for a profit. Like an aircraft leasing company – or any commercial vehicle leasing company.

The market is set up for this too (especially in the EU) where we have drone operator certification, drone certification, and pilot licensing. And the EU is moving ahead with both the rules and the UTM airspace. And we know Aerial inspections take place in the airframe maintenance sector and aerial imagery has long been established.

Flights

So, will the professional drone market emulate the commercial aircraft market? With competing drones flying for a growing community of Operators making money in this brave new world?

Maybe. But our view is that most will struggle to make money. Especially as real-world restrictions take hold.

Bold statement, we know. If you are an advocate for drone urban mobility, then can we suggest you open an app and order a drone-delivered bottle of your choice and hear us out. But just to be clear, we are not saying an autonomous drone won’t work as a platform…

And we are not saying the market for drones does not exist. That would be foolish and demonstrably wrong. We are also not saying that drones cannot complete (some) tasks faster, safer, and more economically than traditional methods.

What we are saying is that drones – as commercially operated vehicles – will struggle to scale in a way where their features and advantages over fossil-fuel burning vehicles (such as the helicopter, car, or moped) can translate to bottom-line profit.

Professional Drones

Let’s make it fair. We are going to give the drone advocates a head start. Let’s jump forward to the future. Say 2026. In this future there will be controlled UTM (Unmanned Traffic Management) airspaces all over the world.

In the future BVLOS (Beyond Visual Line of Sight) will be ubiquitous and the drones are now certified where they can fly in all types of weather, day or night and we have solved system redundancy, safety, and local GDPR privacy issues. We think this is what a good drone landscape might look like.

But this new drone will cost USD $70,000 – $100,000 per unit just to purchase.

And the same costs to operate commercially per year. And like an airline, an Operator will need around ten units for a reasonable offering for her market.

Videos & Inspections Drones

Let’s start with the good news. It seems to us that drones are particularly good when carrying cameras of distinct types. Such as FLIR or other sensors for geographical or topographical studies. If you are a state body or a large infrastructure company, there are cost savings to be made from task-specific drone platforms collecting data.

But from a commercial point of view, this is not scalable to a business. Why? Because the product in these cases is the data being collected. And for (the Operator) need industry-specific knowledge and domain expertise. Which most commercial operators won’t have. He just flies the drone.

And the types of studies being done are not at a recurring level, where an outsource of this service makes sense. These organizations will just do it themselves. They will be the ones who will need to design, calibrate, test, and deliver the data. So, they will be the Operator also.

Aircraft Vs Drones

At the lower technological end of the scale, such as indoor inspections, aircraft inspections, or traffic monitoring, drone operations are easily affordable and don’t need to be outsourced to operators. Our research shows that in the search and rescue area, say police work or looking for lost people in mountains, folks in this space set up drone operations themselves pretty easily.

Again, the product here is specific and bringing in third parties drone operators makes it more difficult and not less.

There might be one area where advanced drones could work in this sector. The automation of inspections in the agricultural or offshore coastal zones. Data capture here is high cost/high risk, and so should be lucrative. And this is very much the cost-saving category as this would normally be done by a specially modified light aircraft.

So, what do we really want? As a commercial drone business?

We want a vehicle that can be cheap to produce, robust, and can fly as many hours and sectors as possible for paying customers. And this leaves the delivery sector. And we want the greatest variety of payload (products) within the densest customer population possible, for scalability.

Drone Law Enforcement

The target potential market for drones is indeed the urban areas around cities where the largest groups of customers are located. And where a delivery market exists. So, what should we deliver? Will we be a low-cost carrier or are we a more “private-jet drone” type service. Our payload will dictate this.

Back to our 2026 drone – it compares favorably with a payload within the 50% total vehicle MTOW range that we would see in other commercial vehicles, like aircraft. In terms of payload weight and size, we are looking at 2-3kgs with a physical limit of 25cmx25cmx15cm. So, a shoebox type size, and with these limitations, you are looking at 2-3 items max.

So here we have our first issue. When you scale down a commercial vehicle, your payload/weight matrix skews. Weight, costs, and power demands don’t match. And the paying customer numbers have also been scaled down compared to a commercial aircraft. To the lowest possible number.

One.

Flight times, Cost and Frequency

What do we mean? Let’s do our first mini calculation. If we look at a B737 with a low-cost carrier we know from the market that the average flight fare for Ryanair is EUR €50. And we can multiply that across an aircraft annual flight hours multiplied by the load factor.

You can read our piece on Load factor and yield management here, but simply put, with the number of seats multiplied by the number of flights/hours, the B737 with 180 seats is an incredibly good commercial tool for making money. A drone does not have this capability as the payload payer is just one.

Let’s look a little closer at this issue of flight frequency versus load factor. A great benefit of the drone is its cost advantage over say, a car. You don’t need me to tell you a Domino’s pizza delivered by drone is cheaper than a 1992 Camry. But our certified 2026 drone is $100K and that’s more expensive than the Camry and it can’t pull up outside the Pizza shop. Or the apartment building.

Round Pizza Drone

Nor can it carry more than one pizza. (Actually, we couldn’t find a drone that was big enough for even a medium pizza, so maybe Chinese food is a better option). But now you have a problem. We are operating a commercial business here. Domino’s will not want a gold-plated, 75k, 200kph drone if it eats into their margins.

They are a franchise, so are the Chinese restaurants, and the guy delivering is not outsourced in such a way that we can show a clear commercial advantage over a car. So, at least in the beginning, these high-frequency convenience deliveries might generate the volume of flights but not the revenue.

Commercial Drone Operations

For our 2026 drone, we need high frequency, but we also need high value. Because we don’t have the volume of client/payloads per flight we would like we need to find the highest-paying payload. To generate the levels of revenue to make sense.

To combat this we would need to carry something of a much higher value.

Because instead of two multipliers (passenger x flights), we have only one. One payload so only one chance to charge the customer. There is an inherent risk here also that relates to the yield factor. If a flight isn’t sold, it doesn’t go.

And so, your load factor is either 100% or 0%. Either that slot is sold. Or lost.

Drone Technology

There is another issue and that is the Airport. Or in our case the Drone Port. For speed, efficiency, and scalability we need an airport-style set-up so that the producers can do the non-flying work we need them to do. Which is to show up at the “gate” with the products to be delivered.

To compete with its natural competitors, the drone needs to solve this problem also. It needs to collect the payload so that it’s convenient for the producers. And given the scale issue, we cannot afford to mess with this issue. Amazon or DHL might be able to solve this issue readily, but we are a start-up commercial operator remember.

And we have many expensive drones, infrastructure, operations bases, and more than one drone pilot. Having more than one base at this level adds costs and requires resources. So, we need a Drone Port for unmanned systems. These don’t yet exist.

Commercial Drone Pilots

Let’s look at a successful commercial drone operation. There’s a guy in Africa that delivers medicine using a novel drone set-up. As you’ll see, it’s very niche and not very scalable or suitable for operation in suburban setting. And his customer is a good one. But even in this medicine/pharma sector, as you get higher up the value chain, the option of a drone makes less sense.

Why? Because you wouldn’t send blood, organs, or high-risk medicines in a drone, given the costs and risks involved.

So there’s a “Drone Value Ceiling”.

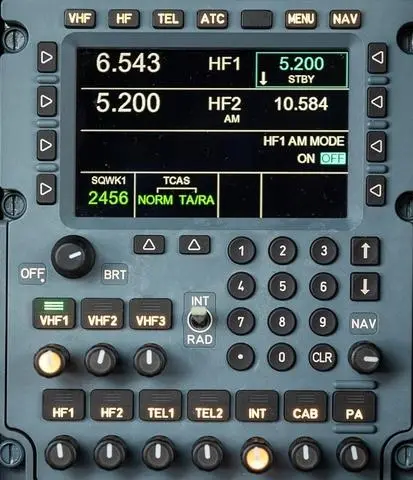

Controlling commercial aircraft is easy, because they follow flight paths or fly in areas that are tightly controlled with equipment that is standardized. Obstacles or obstructions in these areas are quickly mapped and identified. But under a certain altitude this stops being practicable. Our 2026 unmanned systems might operate in controlled airspace to get to and from its destination, but not under that controlled airspace.

Down there, there are no protections against what it might meet on its journey. Yes, it might have some form of Drone artificial intelligence where it can sense its surroundings, but it will be at the mercy of all kinds of dangers.

And as an investor, the capital cost risk at this level starts to become worrying. The risk versus reward of losing a drone, or having it brought down doesn’t sit well with the value of the payload it might be carrying. There is also third-party risk insurance.

Even if the new routes (or UTM) are designated, there’s always the risk our larger, more robust, 2026 drone with strong batteries and complex systems could crash into a house or business, or an electrical station. It would be like dropping a motorcycle from the sky.

Manned Aircraft Vs Drone Pilots

These and other eventualities will need to be accounted for. There is a worry, not about the private invasion of drones (which we expect will be tightly controlled) but the proliferation of drones in general. If you are working in a drone business and trying to make it work, then you will have competition.

Other drones flying to the same areas are competing for the same deliveries. There is also anti-drone tech out there you can buy right now. It really doesn’t take much to divert, hijack or just shoot down a drone as it passes by at low levels.

Finally, we have something we call the Empty Leg. This is when an aircraft must fly between stations without any fare-paying passengers or cargo on board. This can happen when aircraft need to go for maintenance or relocate to an airport that is not its base. Whatever the reason, it’s something we try constantly to minimize.

Depending on the distance, costs can run into the hundreds of thousands for an airplane, but airlines are good at what they do and so these empty legs will be less than 1% of the total number of cycles operated by a single aircraft.

Again, this is down to airports. Because each airport the aircraft operates in is traffic rich. When an aircraft arrives at the airport (if the airline has done its job properly) there are more passengers waiting to board the return (or onward) flight. Big city taxis do the same thing.

They operate within a location where they minimize empty legs by waiting for another fare or using apps, only relocating to base at the end of the shift. And they use the main “ports” of business.

Autonomous Drones

Drone deliveries are one-way only. And the drone must fly back empty to its base before it can embark on another revenue flight. Yes, the DOCs (direct operating costs) are lower than a car (or helicopter), but over time your empty leg flight percentage is closer to 50%. Not 1%.

We are not anti-drone. This is just a look at the considerations of flying drones commercially at scale and what the obstacles might be. In our view, the drones will arrive. But it’s going to have an Amazon logo on its side. Or a FedEx logo.

And they will work from specially adapted Vertiports or trucks where the loading/unloading can be automated. And it won’t be a DJI Matrice 300, it will be larger, able to carry 4-5 items around 10kgs in weight. But this is a long way off. The most recent NPA from EASA (Mar 2022) is still asking for solutions around the UTM space and its management and control, so we are a long way off even having the sandbox we need to start exploring the viability of commercial drones.

We are a long way off even having the sandbox we need to start exploring the viability of commercial drones.