Aviation Finance & Leasing - Roles and Salaries

Looking at a career in Aircraft Finance? let's explore the opportunities

The business of financing the acquisition of new and used aircraft is known as Aircraft Finance & Leasing or Finance. It represents a sizable market with an annual value of more than $100 billion (USD). Commercial aircraft can cost hundreds of millions of dollars and require finance to purchase, such the Boeing 737-800Max and Airbus A320Neo. On the Airline side, there is a considerable demand for financing aircraft, and there are many institutions ready to offer the required finance.

Asset Management

Commercial Aircraft maintain their value (if maintained correctly!), generate a respectable return, and deals are reasonably easy to find depending on your risk profile. Many finance sectors aircraft are seen as ideal assets to finance. They are also covered by advantageous legal frameworks in many jurisdictions, which permit prompt reimbursement in cases of default (Cape Town Convention). In this article we have also have details on the Worlds Top Ten Aircraft Lessors as well as the salaries at the top of those ladders.

Why Finance Commercial Aircraft?

Aircraft leasing is all about financing big machines like airplanes and their engines. And sometimes there are other things that go along with it, like insurance and money put aside for future maintenance (maintenance reserves). These things all make up what we call “assets”.

Now, you might think you know what airplanes and engines are, but there’s more to it than that. Aircraft and engines need overhaul at predetermined points in their lives, dictated by age or usage. Managing the purchase or sale of these assets during peaks and troughs of their life, is how you make (or lose) money.

Aircraft Finance Roles

For some people, like the lessors, these assets are their whole job – they own them, rent them out, and take care of them. For others lenders such as banks or debt providers, these assets are what they use to make sure they get their money back.

Just knowing that these assets are important isn’t enough. To be a real pro in aircraft finance, you must know all the tricky details and be an expert. You need to be technically well-advised, have great tax advice and have the best accountants.

Who needs to Finance Aircraft?

The Aircraft Leasing market exists because…

- Airlines want the cheapest possible cost (rent and return conditions or fees and interest charges

- Lessors can get the maximum return (rent and return condition) and least amount of risk to its Aircraft Asset

- Investors can get the cheapest possible cost (of money) and maximum flexibility for use of the Aircraft Asset (tax jurisdiction)

- Lenders (vis-à-vis the Airline and Lessor) similarly can get the maximum return (fees

and interest income) and least amount of risk to Asset exposure.

The big Risk here… is the Airline you lease to. You get criminally low returns leasing to Delta or Ryanair but there’s zero risk. And you can have double digit returns leasing to a Thai start-up. And hope they last. As well as pay you.

Roles and Rewards in Commercial Aircraft Finance

Aviation finance has specific roles that pertain specifically to the leasing of complex assets that appreciate over time. Both financially and technically. So the top tier people (mostly!) originate from the financial markets, the Engineering and Maintenance area or the Finance area (Think tax).

But the sector is also welcoming to the professionals in areas that are not asset specific. Such as Risk, Legal and Human Resources. We have many pages on getting into various areas of aviation so please have a look around, but remember one thing – If you are good at what you do and can protect asset value or (better still) know when an asset is undervalued… then there is many organizations that would love to speak to you.

In the meantime – here are some of the packages they enjoy…

| Department | Position | Experience | Salary Band ($) | Bonus |

|---|---|---|---|---|

| C-Level | Chief Executive Officer | 10+ Years | $650K - $1.2m | 75%+ |

| Chief Technical Officer | 10+ Years | $300k - $450k | 75%+ | |

| Chief Financial Officer | 10+ Years | $250k - $500k | 75%+ | |

| Commercial | Head of Commercial | 10+ Years | $275k - $350k | 65%+ |

| SVP Commercial | 10+ Years | $200k - $275k | 60%+ | |

| VP Commercial | 10+ Years | $200k - $275k | 40%+ | |

| Contracts | Head of Contracts | 10+ Years | $120k - $160k | 22%+ |

| Senior Contracts Manager | 5-10+ Years | $85k - $120k | 20%+ | |

| Contracts Administration | 1-3 Years | $35k - $55k | 10%+ | |

| Finance | Head of Finance /SVP | 10+ Years | $180k - $240k | 30%+ |

| VP Finance | 10+ Years | $120k - $170k | 25%+ | |

| Financial Accountant | 1-5 Years | $75k - $90k | 15%+ |

Skills and Qualifications for Aircraft Finance Roles

A career in aircraft finance and leasing typically requires a strong background in finance, accounting, and business. Many professionals in this field have a degree in finance, accounting, economics, or aerospace engineering. Additionally, a master’s degree in business administration (MBA) with a focus on finance or a specialized degree in aviation management can be beneficial.

It is also important to have a good understanding of the aircraft leasing industry, including knowledge of aircraft types, manufacturers, and operating costs. Experience in the industry, such as working for an airline or aircraft manufacturer, can be valuable.

Also – here’s a few areas we feel are really valuable.

Strong analytical and problem-solving skills

Familiarity with financial modeling and analysis techniques

Strong negotiation and communication skills

Knowledge of legal and regulatory requirements

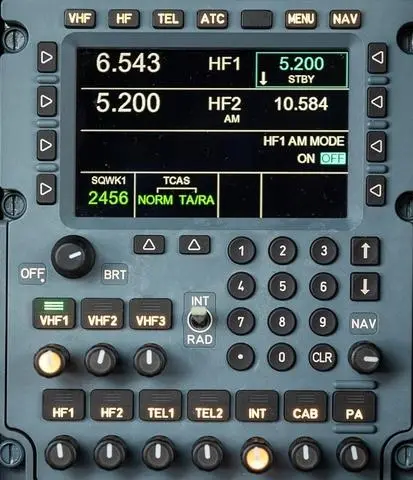

Proficiency in software and technology specific to aviation

Aviation Industry trends and Challenges

Environmental concerns

Climate change and environmental concerns are becoming increasingly important, and the aviation industry will need to find ways to reduce its carbon footprint and environmental impact.

Development of electric and hybrid-electric aircraft

The development of electric and hybrid-electric aircraft is expected to accelerate in the next decade, as the industry looks for ways to reduce emissions and improve fuel efficiency.

Advancements in automation and artificial intelligence

Automation and artificial intelligence are expected to play an increasingly important role in the aviation industry, from aircraft design and manufacturing to flight operations and maintenance.

Increasing use of data and analytics

The aviation industry is expected to become increasingly data-driven, with the use of big data and analytics to improve operations, reduce costs, and enhance the customer experience.

Our Future

Urban Air Mobility

Urban Air Mobility (UAM) is expected to grow, with the increasing use of electric vertical takeoff and landing (eVTOL) aircraft and drones for transportation within cities.

Cybersecurity

With the increase in digitalization and interconnectedness, cybersecurity will be a major concern for the aviation industry, as it is vulnerable to hacking and other cyber threats.

Modification of the Supply Chain

The aviation industry is expected to see changes in the supply chain, with the shift towards more sustainable materials, the optimization of logistics, and the adoption of new technologies such as 3D printing

Sustainability and ESG in Aircraft Leasing

Aviation is responsible for a significant proportion of global carbon emissions, and reducing these emissions is a major area of focus for ESG in the industry. This includes efforts to reduce emissions through the development of more fuel-efficient aircraft and the use of sustainable alternative fuels.

Safety and security are critical concerns for the aviation industry, and companies are expected to have strong governance and risk management practices in place to ensure the safety of passengers, crew, and other stakeholders.

Aerospace players are expected to respect and protect the human rights of its employees, customers, and other stakeholders. This includes ensuring fair and safe working conditions, as well as adhering to laws and regulations related to labor standards.

The aviation industry is expected to engage with and be responsive to the needs of the communities in which it operates. This includes taking into account the impact of its operations on local communities and working to minimize any negative effects.