The Plane Trader Profession is unlike any other

A Plane Trader making a profit from buying, maintaining and selling commercial transport aircraft is hard. And Risky.

Brokering aircraft deals is fast becoming a lost art. I’ve spent many years financing, leasing, and trading aircraft and I’m happy to tell you what I know. Most of it anyway.

Trading Aircraft means you should know every solitary thing about that aircraft, the market, and the competition around that aircraft segment. You should also be a technical wizard, a mind-reader and a predicter of futures.

Trading also requires scaling, so that you can balance your wins with your losses, because you will lose. And scaling is hard when the average price of a used B737 is around $15 million dollars. So, if you get your first one wrong, you’re dead.

What is a Plane Trader?

Whether you are a budding plane trader or just interested in having a quick look under the aviation hood, to learn a little something about aircraft trading, then welcome. Today we are going to try to purchase and sell (or flip) a mid-life B737-800.

So, pull up a chair. And join me as a take on a typical plane trader deal. Can I make money? or will I lose my last shirt?

B737-800 MSN 12787 (CFM56-7B26 Engines)

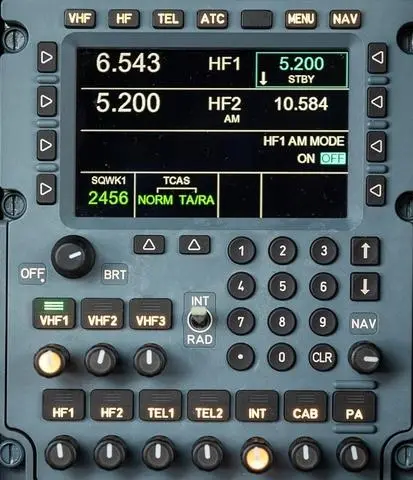

I contacted the buyer a month ago. We are both members of ISTAT so I know I can trust him, and the lien check on the aircraft came back good. I want to buy this aircraft because it’s due several “checks” (bad!), but the price is right (good!). And the engines are in decent shape (more on that later).

Five AMTs travelled to the aircraft and went over the critical areas of the airframe, borescoped the engines and checked the historical records. This inspection cost me around USD $25,000 and took around 5 days.

Now – if they’d found something bad, or just didn’t like the paperwork, I would’ve pulled the plug right here. Sure, I’d have lost all that inspection money, but I would have gotten my deposit back. Pre-inspections are an expensive but vital practice. You miss something now, the more expensive it gets down the road.

At Contract Closing

The aircraft checks out and so we move to an agreement or a Letter of Intent. I will purchase the aircraft via a SPV (special purpose vehicle) where I can be tax efficient (in Ireland, or Malta) and reregister the aircraft onto the Irish, Maltese, Isle of Man registry.

I got a great deal at $10 million and so I sign the agreements and plan to ferry the aircraft (and records) to Canada. Along with the $10m, the lawyers cost me $125k and the ferry flight cost me USD $35k. There’s also insurance and I need to engage with a CAMO (continuing airworthiness management organization) for the maintenance cover.

For the next 6 months while the aircraft is being converted, they will cost me a further USD $100k. Now that my aircraft is in the hanger, I finalize the contract with the MRO for the P2F conversion. The conversion and the checks due on the aircraft will cost me another USD $6m.

When plane traders sell

This is because an LCD (large cargo door) is being installed so IATA standard pallets can be loaded. But I can pay this in milestones as the work is being completed. The engines are in decent shape. They have around 2,500 cycles (flights) remaining and the EGT (engine gas temperature – an indication of life remaining) is respectable.

But if I had to replace just one engine, or put it in for an overhaul, this could cost me another USD $3.5m. But wait – in month number two I did get some sad news. During the check, they noticed that the wing spar on one side had corrosion.

Plane Trader Profit

I worried this might happen as the aircraft is ex-Hawaiian. I checked the CPCP (corrosion protection program) and felt I was in decent shape, but not so. I now have an additional bill of USD $1m in corrective measures that were unplanned.

"Say Hello to my little B737F"

It’s now six months later and the aircraft has completed all the technical work and rolls out of the paint shop nice and white. The paint was extra and cost me USD $67k. The aircraft does three test flights to make sure all systems are working properly, and everything is put back together so we can get the export Certificate of Airworthiness.

These flights and related post-delivery technical work cost me USD $50k. But just when I am starting to feel confident, the FAA releases an AD (airworthiness directive) on the landing gear of my vintage B737.

With no choice I have to hanger the aircraft again and have the affected pylon checked and replaced. This adds another USD $250k to the bill and takes another month while I queue up with all the other B737 owners to get hold of the limited parts.

Time for The Big Sale

Now I might look kinda dumb, but I am not. And while you thought I was just sitting around spending money like a Saudi Prince, I was in fact out there in market trying to find an airline customer for my B737F. And good news, there’s a lot of interest.

Thanks to Covid and the drop in aircraft flights, a dedicated freighter is in high demand and so my list of potential operators is healthy. But the B737 (P2F) business is risky, and I had no way of engaging these guys until now.

Plane Trader Topics

They are smart, like me, and know that when you cut into the metal of a perfectly good B737, it’s not a sure-fire guarantee that the product will be worthy of flight. But it is. And now that it’s on the ramp they can kick the tires and I can hold my head, and wallet, up high.

Most of them want to buy it outright. Of course they do. I have de-risked it and now they want to limit the amount of money it’s going to cost them and/or reflect better on their balance sheet. But I’m an experienced trader and I know how to maximize the return on this deal. I hold firm for a lease to a top tier airline in the Middle East.

Aviation Industry

They are state-owned and fly every other flavor of Boeing aircraft and have an AAA+ rating. The lease rate is good (USD 250k per month plus maintenance reserves) for ten years with an option for another five.

But I’m not finished yet, I took my B737F, which I still own, and I shopped around the big leasing and finance firms for SALE WITH A LEASE ATTACHED. Because an aircraft that’s already on a good lease with a great airline will carry a premium on the sale price. Around 15-20% thanks to the value of the future cash.

All told, I make around $5-$7m dollars pre-tax and after expenses on the deal. But given the risks I took, the money I put on the line and potential for disaster, that’s about correct. But if one of my engines was kaput, or there were major gaps in the paperwork (or any other problem) then that margin would drop quickly.

Plane Ride

Yes, I could have “flipped” the aircraft. After I purchased it, if I got lucky and added a little bit of value, I could have made $1-2m just by making sure it wasn’t a dud, but that’s hard in 2022 when there are many companies out there with big cash buckets looking for solid aircraft.

I could also have looked at the wide-body market – an older A330, the new B797 or a beautiful B777-300ER. But the price tag is now USD $20m and my overheads go stratospheric in line with the heavier metal. And those engines, such as the GE90-115 on the triple seven, will cost me USD $10m each if the news is bad.

That’s one engine, $10,000,00.00. And all those other costs like ferry, insurance, CAMO maintenance and the pre-inspection have all doubled. Tripled if it’s an A340 or a B747 with four engines instead of two.

Plane Trading 101

Hopefully, this gives you a small snapshot of the fundamentals of an aircraft deal. This one had a little more hair on it than a basic deal, but it does highlight the kinds of things a plane trader needs to be good at. Or at the very least competent. Or risk losing tens of thousands just wandering around looking at aircraft or even millions getting it wrong in the wrong places.

There is also a myriad of other things that can happen – far too many to go into in one article. The ownership structure must be robust, and already be in place and set up by more lawyers, accountants and international tax specialists or you can say goodbye to another 20-30% in a kaleidoscope of taxes.

Aviation Enthusiast

The technical/trace paperwork is also a mountain of risk that cannot be 100% verified otherwise deals would never be done and the physical technical inspections are limited to what can be seen without taking things apart or major surgery.

And some airplanes have bad secrets – like us brokers – that they keep hidden deep inside. Revealing them only at the worst possible moment, in the worst possible market. Or just when a pandemic hits.