Risk managers are smart. They know everything.

Why? Because they are our lookouts. They’re in the crow’s nest. Overseeing their ships and looking out for icebergs. These people know more than the CEO.

They understand intimately how the business makes or saves money. Risk management professionals have one eye on the market. The other on costs.

They look for threats before threats find them.

Potential Risks

If you think Risk Management sounded boring, then we are here to smarten you right up. Risk managers know their business by knowing everyone else’s too.

I was the head of Market Risk for a Forbes Top 100 company with an aircraft leasing arm. I would like to give you a brief (and humble) look at how Risk Managers look at Airline risk specifically. But the mitigation of risks is fundamentally the same for all business sectors.

Financial Risk

We are not here to say Risk Management is sexy. Unless you love accounting and forensic financial work. But the mitigation of risk can be exciting. Especially when you are hunting threats. So, if you thought the sales guys were the hunters? Nosirreebob. The Risk Managers are the real hunters. And their prey can be the hardest to catch.

Now all business is operational risk. You invest time and money in a product or service in the hope people will pay you for it. And that the money coming in, exceeds money going out.

Or you have market investment risk. Where you take a risk position in companies others are afraid to, and you profit. As an aircraft investor (lessor), when you give your limited resources (an aircraft) to a customer (airline), you now take a risk that they will, or will not, pay you over time. Sometimes decades.

Project

An example. An aircraft leasing company leases a Boeing 737 to an airline. The airline pays lease rental to that company, and we hope for a “stable” lease. The risk here is the debt on the aircraft loan versus the market desire for that aircraft. But the lease can become “unstable”, if the B737 was the wrong aircraft for that airline, your risk is that they return it early.

And their asset risk is lower than yours. And many other things can happen that could result in them not paying you. Since Covid started in 2019, most airlines in the world stopped paying rent on aircraft for a sustained period.

And the banks could do nothing. It was the worst mass payment holiday in aviation history.

Costs

Ok, let’s get practical. Let’s assume the position of Risk manager. What should have been my action plans for risk management – and what have I learned to do in the future?

Q. When are the Risk action plans made?

All the time. When a leasing company is set up, its risk management strategy will be in the business plan. Because the lenders will want to know the effects of risks. Here are the questions they will ask the Lessor.

- What Aircraft types will you invest in? Will they be new or used? Are they single-aisle or wide-body? Long haul or small regional turboprops?

- Which airlines will you lease to? Tier “A – Alpha”? or Tier “Zulu”. Are they United or a state-owned flag carrier? Or a new low-cost start-up in Angola called Funk Air?

- What continent are they based on? In which country? Where will they fly to? Who are they competing with? Are the passenger’s business or leisure

- Who are their investors? How is their debt structured? From a bank, or a high-net-worth individual who is bored with his beer or shoelace business

- What is your remarketing strategy? If the plan changes. What is your “ready response” if you encounter a default event

The Risks – Step 1

You will answer these questions in the form of your strategy. We call it portfolio management or asset management. And it’s pure science. We don’t want any art here. In a perfect world, you have a balanced aircraft portfolio, or other critical assets, where you have a variety of aircraft types as well as airline customers. Airlines that serves different market segments based in different parts of the world.

These airlines would preferably have some sovereign ownership or at least deep-pocketed owners. As owner, you employ a project team of professionals that can swoop in, take the aircraft back and have it leased out again lickety-split. In aviation, 2-3 months would be a fast re-lease. But 8-12 months of market risk is common.

In the aircraft leasing business, you must take some risks. British Airways or United Airlines pay tiny margins to lessors or lenders (if they do business with them at all). Because everyone wants to extend credit to them. They are AAA “risk”. As a lessor, for every premium lease you have, you must do business in Colombia. Or Algeria.

Or with a new Estonian start-up. Or else you won’t break even in aircraft leasing, much less make margin.

Risk Management

Each aircraft in your beautifully balanced portfolio will fall into one of these categories.

Aircraft Status Stable – all good. Business as usual.

Restructure – The airline customer needs to make a change. They need to modify your lease.

Repossession – The airline is broken, and you need to get your aircraft back. Here are the core elements you need to address. Financial, technical, and valuation components must be understood and reported with a risk valuation component that is actionable.

Credit Reviews

An internal audit is done both at the beginning and constantly. And throughout the lease.

The things you are looking at are;

- Airline liquidity

- Airline cash burn rates

- Airline Survival “Horizon”

- A downside scenario plan (or three)

- Financial stress analysis

- Enhanced impairment assessment

- Real-time asset valuations

- Maintenance reserve calculations

- OEMs – should support the industry as a whole

- State agencies

- Lenders/Investors

- Legal Liabilities

Effective Risk Management

Combats the potential impact of changes in Status. Let’s look again at the different statuses and how we might typically respond in the real world. After Covid, this is how we reported a potential impact back to our board.

Stable – Very few airlines were stable. Only top tier, liquid, and government backed airlines. But 99.9% of airlines wanted lease holidays or deferrals. Stability became non-existent.

The Response – Deferrals were granted. Not much choice. Get as much cash as you can and apply as many penalties or interest on the deferred payments as you think you can get away with. While keeping a relationship with the airline. But the lease rates and terms are unchanged.

Restructure – The Airline can no longer afford to keep paying the same rate and needs a better deal.

Response – Scenario planning is key. Varying new scenarios is done through internal audits. Should we stick around at these rates? What does that even look like? Is the grass greener elsewhere? The devil you know. If you do decide to stick around, try to restructure the lease in line with traffic recovery. This helps the airline, and we minimize our time at the lower $$ levels.

Repossession – The very last resort. Taking commercial aircraft back involves state agencies at all levels and in many jurisdictions. The aircraft location, the owner country, and the new destination. Even when done properly it’s extraordinarily complex with a lot of red tape. So, everything is done to avoid the acrimonious repossession.

Why? The main reason is the aircraft records. Without them, the aircraft is worthless. Those tv shows where guys sneak aircraft out of airports at Midnight? Not a thing. If you tried that, the next time that aircraft flies it will be into your kitchen cupboard as a pot or a pan. Because that’s all they’ll be worth. Approach to Risk management 101 – Stay friends with your lessees. Get your paperwork back…

Which Risk Modeler?

Remember this is aircraft leasing specific, but just swap Aircraft out for your project and the risk modeler will be the same. The behavior of lessees is also the same and if you consider these elements, you won’t be stuck looking at a blank .xlsx sheet when the CEO falls sobbing at your desk.

Find out what your client is doing – right now. Ask them.

- Are they filing for bankruptcy? Have they done this before, what can I expect?

- Are they seeking aid? State, or otherwise. What’s my debtor position?

- Are they speaking to other lessors or banks or suppliers? Should you speak to them too?

- What’s your legal position? What conventions are in place? (i.e. Cape town) What has this country done in the past? Protect the airlines or the debtor?

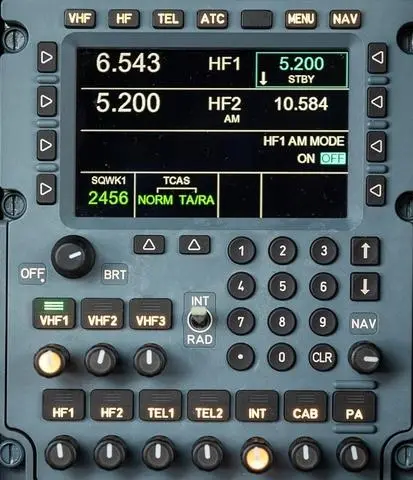

- Is the aircraft serviceable? Does big money need to be spent soon on maintenance? Where are the records? Can I send someone to verify them?

- Are slots available at maintenance shops for the work I might need to get done?

- What is the Chapter 11 timeframe? Is it 5 months, or 5 years?

- Who else would take my aircraft right now? What’s their risk profile? What does the landscape look like if they survive? Does my aircraft fit with their future shape?

Enterprise Risk Management

Some of these questions are difficult to answer and impossible in the period that you might be given for it to have an impact. The airline CEO could be doing any number of things in the background that you won’t see. The only tool you have is your experience and your relationship with the people at the airline. And their character.

You need to have chosen wisely and hope that they will act as you predicted. Aviation is critical to trade, tourism, and infrastructure for all countries. Airlines are also a source of pride and identity for states and their people. But most important to you is how they behave when an airline is in trouble, because this is critical for how they will be treated in the future, when good times return.

If a state does everything it can to help the airline, at the cost of the lender, they run a huge risk of not getting more credit down the road. Or being shunned by other lessors. They know everyone is watching and are very conscious of this.

Businesses

Some countries, which we won’t mention, are notorious for this. And this is reflected in the high prices they pay thanks to the risk profiles they now have. Anyone who declares bankruptcy as a private person knows what I mean.

Sometimes, Airlines perform Las Vegas magic tricks. They disappear on Friday and reappear on Monday under a new name. And sometimes not particularly different from the old one. Some European flag carriers have done this on multiple occasions. In Greece and Italy.

So, if you are interested in Risk Management then It doesn’t matter what role you have in aviation, but I am telling you right here, right now that if you have the time to get a diploma or higher qualification in Risk Management you won’t be sorry. It’s an industry secret that – just like the B757, wonderful sports car of the sky – that Risk management’s “power-to-weight” ratio is the highest.

C-level people and their Board member friends love to see it on CV’s. And value those that can be relied on for answers to risk in times of their greatest need.