Aircraft Finance - Roles and Career Paths

Let’s dive into the exciting world of Aircraft Finance Jobs and leasing. If you are someone coming from outside the industry, it is essential to understand the various assets involved in aircraft financing. These assets range from the typical, such as aircraft and engines leases, to other, more targeted transactions that are associated with standard aircraft financing, such as sale-and-leasebacks (SLBs) and ABS structures.

Whole “aircraft”, “airframes”, and “engines” which are common terms but there are certain subtleties worth noting in their definitions. These aircraft assets are at the heart of the aircraft finance business. Lessors own, lease, manage and sell them. While lenders use them as collateral to assure repayment. Only with these assets as security do specialized aircraft-asset-based lenders extend credit.

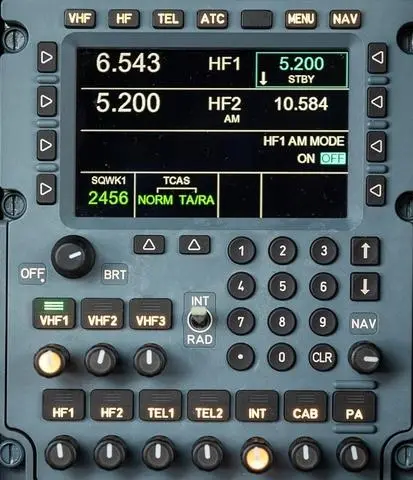

We want to explore the skills, expertise and training required to be an aircraft finance professional, including some technical aspects of aircraft assets. Yes – knowing what an AD or SB is, or what a C-check is can be valuable, especially in interviews. However, it’s important to note that this article is just a scratch on the surface of this highly complex field.

Growth of Aviation Leasing in Dublin

Tony Ryan, the creator of Guinness Peat Aviation, was the man who first popularized the aircraft leasing sector. Since then, Ireland has handled a lot of leasing deals because of its financial know-how and advantageous corporate and bilateral tax laws. Even though Guinness Peat Aviation’s demise was a tragic event, it also sowed the seeds for a number of new businesses, including Avolon and Aercap, which are now both major players in the world’s aircraft leasing market.

Although Hong Kong and Singapore have recently begun to emerge as potential hubs for leasing companies, Ireland will still play a significant role. As for the future, leasing firms consider the rising economic activity in China and the Asia-Pacific area as a promising market. The market is split between two groups. The Lessor’s, who borrow and are equity participants in leases – they have skin in the game – and Asset Managers. Also called Servicers, they do not have a financial interest in the assets and just manage the flow of cash and oversee the technical management of the aircraft.

What is an Aviation Industry Asset Manager?

Let’s start with the simpler of the two.

A Servicer manages the proactive management of the components, services, and expenses associated with sustaining one or more airplanes across the course of each aircraft’s useful life, from original acquisition to final disposition. This is aviation asset management.

Servicers work with a combination of 3rd party providers such as CAMOs and MROs. Most have software links that are incorporated into an operator’s continuing interactions with MRO partners. This enables seamless integration with the owner’s systems, software is ideally tailored to meet the management structure of the owner of the aircraft.

In any case, maintaining an aircraft over the course of its useful life is expensive, especially for big commercial aircraft. And when an investor has a large fleet of aircraft to maintain, an organized management of the maintenance assets becomes crucial.

Lowering ownership costs, improving aircraft performance, extending the useful life of aircraft, and providing more accounting flexibility, including converting capital expenditures into easier-to-manage operational costs, are the main goals of aviation asset manager. Additionally, it protects aircraft residual values while enhancing aircraft safety through part tracking and verification.

What is an Aircraft Lessor?

Aircraft leasing is when companies rent planes to airlines who don’t want to buy them outright. It’s a big business that involves a lot of money and planes. Basically, the aircraft leasing company buys a plane and then rents it out to an airline for a set period of time.

But there are big challenges to this business. One of them is the impact it has on the environment. Planes produce emissions, which is not good for the planet. So, the aircraft leasing companies must find ways to reduce the impact of these emissions. They can invest in newer planes that are more fuel-efficient, or they may look at ways to offset their carbon footprint. Another challenge is the competition in the market. There are a lot of aircraft leasing companies out there, so they have to find ways to stand out and offer better deals to their customers.

Business Activities of a Lessor

Sale-Leaseback Transactions:

Aircraft leasing companies often engage in sale-leaseback transactions, which involves selling an aircraft to a third party and then leasing it back from them. This provides the lessor with an immediate cash injection and allows the lessee to continue using the aircraft without having to pay for it outright. Sale-leaseback transactions are a common way for airlines to finance new aircraft purchases or to raise capital for other purposes.

New Commercial Aircraft Orders:

Aircraft lessors are major customers of aircraft manufacturers, placing orders for new commercial aircraft to lease to airlines. By placing large orders, lessors can negotiate favorable terms with manufacturers, such as discounts on purchase prices or priority delivery slots. New commercial aircraft orders can be a significant investment for lessors, but they provide a steady stream of income through leasing agreements with airlines.

Trading Aircraft:

In addition to purchasing new aircraft, aircraft leasing companies engage in trading, which involves buying and selling used aircraft. This involves purchasing aircraft from airlines or other lessors, completing maintenance or upgrades to the aircraft (or engines), and then selling or leasing them to new customers. Trading aircraft can be a lucrative business, but it also requires expertise in the evaluation of aircraft.

Credit Evaluation:

Aircraft leasing companies must evaluate the creditworthiness of their “lessees” (airlines) before entering into leasing agreements. This involves assessing the financial health of the lessee, including their revenue, operating expenses, and debt levels. A thorough credit evaluation helps lessors mitigate the risk of lessee default and ensure payment of income from leasing agreements.

Asset-Backed Securities (ABS):

Aircraft leasing companies can “bundle” their leasing agreements into asset-backed securities (ABS), which can be sold to investors. ABS special purpose vehicles provide a way for lessors to raise capital and reduce risk by diversifying their portfolio of leased aircraft. ABS can be structured in different ways, such as with a single class of investors or multiple classes with different levels of risk and return.

Enhanced Equipment Trust Certificates (EETC):

EETCs are another way for aircraft leasing companies to raise capital. EETCs are a type of bond offering where investors purchase certificates secured by the aircraft assets of the lessor. The certificates have a fixed interest rate and maturity date and are paid off from the lease payments received from lessees. EETCs can be an attractive investment for investors seeking stable returns and low risk.

ESG Considerations:

Environmental, social, and governance (ESG) considerations are becoming increasingly important for aircraft leasing companies. As major investors in the aviation industry, lessors have a legal responsibility to address issues such as climate change, social responsibility, and ethical governance. This can include initiatives such as reducing carbon emissions, investing in sustainable aviation fuels, and improving labor practices.

Aircraft Finance Job Salaries 2024

| Department | Position | Experience | Salary Band ($) | Bonus |

|---|---|---|---|---|

| C-Level | Chief Executive Officer | 10+ Years | $650K - $1.2m | 75%+ |

| Chief Technical Officer | 10+ Years | $300k - $450k | 75%+ | |

| Chief Financial Officer | 10+ Years | $250k - $500k | 75%+ | |

| Commercial | Head of Commercial | 10+ Years | $275k - $350k | 65%+ |

| SVP Commercial | 10+ Years | $200k - $275k | 60%+ | |

| VP Commercial | 10+ Years | $200k - $275k | 40%+ | |

| Contracts | Head of Contracts | 10+ Years | $120k - $160k | 22%+ |

| Senior Contracts Manager | 5-10+ Years | $85k - $120k | 20%+ | |

| Contracts Administration | 1-3 Years | $35k - $55k | 10%+ | |

| Finance | Head of Finance /SVP | 10+ Years | $180k - $240k | 30%+ |

| VP Finance | 10+ Years | $120k - $170k | 25%+ | |

| Financial Accountant | 1-5 Years | $75k - $90k | 15%+ |

Top 10 Aircraft Finance Positions

Chief Executive Officer (CEO)

Chief Financial Officer (CFO)

Chief Operating Officer (COO)

General Counsel

Senior Vice President of Marketing and Sales

Head of Technical Operations

Head of Risk Management

Head of Corporate Development

Senior Vice President of Trading and Portfolio Management

Head of Tax and Treasury

Chief Executive officer (CEO)

Responsibilities

- Developing and implementing the company’s strategic plan and business objectives

- Building and maintaining relationships with key stakeholders such as airlines, financiers, and manufacturers

- Overseeing the company’s financial performance and ensuring profitability

- Managing the company’s risk profile and ensuring compliance with regulations

- Leading and managing the executive team and overall staff

- Setting the company culture and values

- Representing the company in industry events and forums

- Developing and maintaining a network of industry contacts

Required skills and qualifications

- Bachelor’s degree in business, finance, economics, or a related field

- Extensive experience in the aviation industry, ideally in aircraft leasing or finance

- Strong leadership and management skills, with a proven track record of success in a senior executive role

- Experience in developing and implementing successful business strategies

- Excellent communication and negotiation skills, with the ability to build strong relationships with stakeholders.

Chief Financial Officer (CFO)

Responsibilities

- Oversee the financial operations of the company, including budgeting, forecasting, financial reporting, and accounting

- Develop and implement financial strategies that align with the company’s overall goals and objectives

- Manage financial risk and ensure compliance with regulatory requirements

- Provide guidance and support to other members of the executive team on financial matters

- Monitor industry trends and make recommendations for financial changes or improvements

- Build and maintain relationships with investors, lenders, and other stakeholders

Required skills and qualifications

- Bachelor’s or master’s degree in accounting, finance, or a related field

- CPA (Certified Public Accountant) or equivalent certification

- Several years of experience in a senior finance role, preferably in the aviation industry or a related field

- Strong analytical and problem-solving skills, with the ability to develop and implement financial strategies

- Excellent communication and interpersonal skills, with the ability to build relationships with internal and external stakeholders

- Knowledge of accounting principles and financial regulations, with the ability to ensure compliance

- Experience with financial reporting and analysis tools and software

Chief Operating Officer (COO)

Responsibilities

- Oversee day-to-day operations of the lessor’s aircraft leasing business, including leasing agreements, asset management, and customer relationships

- Develop and implement operational policies and procedures to ensure efficient and effective business practices

- Monitor industry trends and evaluate their potential impact on the lessor’s operations

- Collaborate with other executives and departments to identify opportunities for growth and improvement

- Lead and motivate the operations team to achieve business objectives and provide exceptional customer service

Required skills and qualifications

- Bachelor’s degree in business administration, finance, or a related field; MBA preferred

- Several years of experience in senior management roles, preferably in aircraft leasing or a related industry

- Strong leadership skills and experience managing teams

- Knowledge of financial modeling and analysis, as well as lease contract negotiations and structuring

- Excellent communication and interpersonal skills, with the ability to build and maintain relationships with customers, partners, and industry stakeholders

Chief Technical Officer (CTO)

Responsibilities

- Develop and implement the technical strategy and vision of the company.

- Lead the technical team responsible for maintenance, repairs, and modifications of leased aircraft.

- Ensure compliance with regulatory requirements related to maintenance and airworthiness of aircraft.

- Oversee the technical aspects of aircraft acquisitions and dispositions.

- Develop and maintain relationships with OEMs, MROs, and other vendors and service providers.

Required skills and qualifications

- Bachelor’s or master’s degree in engineering or a related field.

- Significant experience in aircraft maintenance, engineering, or related field, with a minimum of 10 years in a leadership role.

- In-depth knowledge of aircraft systems, structures, and operations.

- Familiarity with regulatory requirements related to aircraft maintenance and airworthiness.

- Experience with lease transactions and technical aspects of aircraft acquisitions and dispositions.

- Strong communication and leadership skills.

General Counsel

Responsibilities

- Providing legal advice and guidance on business matters to senior management and other stakeholders

- Drafting and negotiating contracts and other legal documents

- Managing the company’s litigation and dispute resolution processes

- Ensuring compliance with legal and regulatory requirements, including aviation and leasing regulations

- Advising on intellectual property matters, such as trademarks and patents

- Managing and overseeing outside legal counsel as needed

Required skills and qualifications

- Juris Doctor degree from an accredited law school

- Membership in good standing in a state bar association

- 15+ years of experience since admission to the Bar, including experience in the aircraft leasing industry either with a law firm or with an international aircraft leasing company

- In-depth knowledge of relevant legal and regulatory frameworks

- Strong communication, negotiation, and problem-solving skills

- Ability to work well under pressure and manage multiple priorities

- Experience managing and developing legal staff and outside counsel

SVP Marketing and Origination

Responsibilities

- Develop and execute the company’s marketing strategy to promote its services to potential customers and maintain relationships with existing ones

- Manage and oversee the marketing team to ensure their work aligns with the company’s goals and objectives

- Conduct market research and analyze trends to identify opportunities for growth and competitive advantage

- Collaborate with other departments, such as Sales and Operations, to develop integrated marketing campaigns that align with their objectives

- Manage the company’s brand identity, messaging, and creative assets to ensure consistency across all channels and touchpoints

Required skills and qualifications

- Bachelor’s or Master’s degree in Marketing, Business Administration, or a related field

- 10+ years of experience in marketing roles, preferably in the aviation or financial industry

- Strong understanding of the aviation industry and its trends, as well as the competitive landscape

- Proven experience in developing and executing successful marketing strategies and campaigns

- Strong leadership and management skills, with experience managing and developing teams

- Excellent communication and interpersonal skills, with the ability to build relationships and negotiate with partners and customers.

Head of Risk Management

Responsibilities

- Develop and implement risk management policies and procedures

- Identify, evaluate, and prioritize risks across the organization

- Manage and analyze risk exposure and develop strategies to mitigate risks

- Monitor and report on risk management activities to senior management and board of directors

- Work closely with legal and compliance teams to ensure regulatory compliance

- Collaborate with other departments to identify and address potential risks in business operations

- Conduct risk assessments for new business ventures and investments

- Provide guidance and training to staff on risk management principles and practices

Required skills and qualifications

- Bachelor’s or Master’s degree in finance, accounting, business, or a related field

- At least 7-10 years of experience in risk management, preferably in the aviation or financial industry

- Strong knowledge of risk management principles and practices, including quantitative risk analysis and modeling techniques

- Excellent analytical and problem-solving skills

- Strong communication and interpersonal skills, with the ability to communicate complex risk issues to non-technical stakeholders

- Ability to work effectively in a team environment and to lead and motivate a team of risk professionals

- Experience with regulatory compliance and risk management frameworks, such as COSO or ISO 31000

- Professional certifications such as Certified Risk Manager (CRM), Financial Risk Manager (FRM), or Chartered Enterprise Risk Analyst (CERA) may be preferred or required.

Corporate Manager (ESG/Sustainability)

Responsibilities

- Develop and implement ESG and sustainability strategies, policies, and initiatives for the organization

- Ensure compliance with relevant ESG regulations and standards, and develop reporting mechanisms to track and communicate progress

- Engage with internal stakeholders, including senior leadership, to promote and embed ESG and sustainability considerations into business decisions

- Engage with external stakeholders, such as investors, regulators, and industry groups, to stay abreast of ESG trends and best practices

- Coordinate and collaborate with other departments, such as marketing, legal, and risk management, to ensure ESG and sustainability considerations are integrated into all aspects of the organization’s operations

Required skills and qualifications

- Bachelor’s or master’s degree in environmental science, sustainability, business, or related field

- Experience working in ESG or sustainability-related roles, such as at an ESG consulting firm or in-house at a company with a strong ESG focus

- Strong understanding of ESG frameworks and standards, such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD)

- Strong project management skills, with the ability to lead cross-functional teams and drive results in a complex, fast-paced environment

- Excellent communication and interpersonal skills, with the ability to effectively engage with both internal and external stakeholders on ESG and sustainability topics.

SVP Trading & Portfolio Management

Responsibilities

- Develop and execute trading strategies for aircraft leasing portfolios

- Manage the company’s portfolio of aircraft assets, including buying and selling aircraft

- Analyze market trends and make investment decisions accordingly

- Oversee portfolio management team

- Work closely with other departments such as finance and legal to ensure compliance with regulations and contracts

- Develop and maintain relationships with key industry partners such as airlines and financial institutions

- Evaluate and mitigate portfolio risks

Required skills and qualifications

- Bachelor’s degree in finance, business, or related field; MBA or equivalent preferred

- Extensive experience in aircraft leasing, aviation finance, or related field

- Strong understanding of financial markets and investment strategies

- Excellent analytical and problem-solving skills

- Proven track record of successful portfolio management

- Strong leadership and management skills

- Excellent communication and interpersonal skills

- Ability to work well under pressure and meet tight deadlines

VP Origination

Responsibilities

- Develop and execute strategic plans to source and originate new aircraft leasing transactions

- Build and maintain relationships with airlines, lessors, financial institutions, and other potential partners

- Conduct market research and analysis to identify opportunities and market trends

- Lead negotiations and structuring of aircraft leases and financing agreements

- Work closely with other departments such as legal, risk, and finance to ensure smooth and successful transactions

- Manage a team of origination professionals and provide guidance and mentorship

Required skills and qualifications

- Bachelor’s or Master’s degree in Business, Finance, or related field

- At least 8-10 years of experience in aircraft leasing or related industry with a proven track record of origination and deal execution

- Strong knowledge of aviation and leasing industry, including regulations and market trends

- Excellent analytical and financial modeling skills

- Strong communication, negotiation, and relationship-building skills

- Ability to work in a fast-paced, dynamic environment and manage multiple transactions simultaneously

- Experience managing and mentoring a team of professionals

VP Technical

Responsibilities

- Oversee technical asset management and maintenance for the lessor’s portfolio of aircraft and engines

- Manage relationships with airlines, MROs, and other technical service providers

- Develop and implement maintenance, repair, and overhaul strategies to optimize asset value and minimize costs

- Ensure compliance with regulatory and safety requirements

- Participate in aircraft acquisition and disposition processes, providing technical expertise and guidance

- Work with other teams (e.g. trading, origination, risk management) to assess technical risks and opportunities associated with new investments

Required skills and qualifications

- Bachelor’s or advanced degree in aerospace engineering, mechanical engineering, or a related field

- At least 10 years of experience in the aviation industry, with a focus on technical asset management, maintenance, or engineering

- Experience managing technical teams and projects

- Strong technical knowledge of aircraft and engine systems, as well as industry standards and regulations

- Familiarity with maintenance and repair practices and their impact on asset value

- Excellent analytical and problem-solving skills

- Effective communication and interpersonal skills, with the ability to work collaboratively with internal and external stakeholders

Airline Financial Analyst

Responsibilities

- Analyze financial statements and evaluate creditworthiness of potential customers and lessees

- Develop financial models and forecasts to assess investment opportunities

- Participate in the structuring of lease transactions and negotiate lease agreements

- Monitor and analyze the performance of the aircraft leasing portfolio

- Conduct research and analysis on industry trends and competitive landscape

- Prepare and present financial reports and presentations to management and external stakeholders

- Assist in the preparation of financial statements and regulatory filings

Required skills and qualifications

- Bachelor’s degree in Finance, Accounting, or related field

- 1-3 years of experience in financial analysis, preferably in the aviation or leasing industry

- Strong analytical and problem-solving skills

- Proficiency in financial modeling and Excel

- Excellent communication and interpersonal skills

- Ability to work independently and in a team-oriented environment

- Knowledge of accounting principles and financial statement analysis

- Understanding of aircraft leasing and finance structures is a plus

Aircraft Appraiser

Responsibilities

- Conducting aircraft appraisals and valuations for internal decision making or external customers

- Keeping up-to-date with current market trends and conditions to ensure accurate valuations

- Preparing reports and presentations on appraisals and valuations for internal and external stakeholders

- Providing support to other departments within the company on matters related to aircraft values

Engineers and Technical Roles at an Aircraft Finance Companies

Overall, engineering and technical roles are crucial to the success of aircraft leasing companies. They ensure that the lessor’s fleet is safe, reliable, and maintained to a high standard. They also play a vital role in evaluating potential acquisitions, managing leases, and disposing of assets, which are all key activities for lessors.

Lessors need a lot of technical expertise and offer great renumeration for top talent. Here are some activities at the technical roles at Lessors.

Aircraft Acquisition Practice:

Technical Asset Managers, Technical Services Managers, and Technical Consultants are responsible for evaluating potential aircraft acquisitions, determining their suitability for the lessor’s fleet, and performing technical due diligence.

Maintenance and Repair advice:

Aircraft Maintenance Managers, Powerplant Engineers, Avionics Engineers, Structures Engineers, Quality Control Inspectors, and Technical Records Analysts oversee maintenance and repair operations on the lessor’s fleet. They ensure that all aircraft meet regulatory requirements, are airworthy, and maintain their value.

Lease Management:

Technical Directors and Technical Asset Managers oversee the management of leases, ensuring that all lease obligations are met, including maintenance requirements and technical compliance. They also monitor aircraft utilization, maintenance events, and lessee compliance.

Sale-Leaseback Transactions:

Technical Consultants and Technical Asset Managers perform due diligence on aircraft being considered for sale-leaseback transactions. They evaluate the technical condition of the aircraft, determine the expected maintenance costs over the lease term, and ensure that the lease rates are appropriate.

Asset Disposition:

Technical Services Managers and Technical Directors oversee the process of asset disposition, including the sale of aircraft, engines, and parts. They manage the maintenance and repair of assets, market them for sale, and oversee the sale process.

Top 5 financial institutions involved in debt provision

Bank of America

CitiGroup

JPMorgan Chase

Wells Fargo

Morgan Stanley

Aircraft Leasing FAQ's

What qualifications are required to work in aircraft leasing?

Qualifications vary depending on the specific role, but typically include a bachelor’s degree in finance, economics, accounting, or a related field. Relevant experience in finance or aviation is also beneficial. As an engine, B1/B2 FAA or EASA license’s are also a minimum for technical roles.

What skills are important for success in aircraft leasing?

Skills important for success in aircraft finance include financial analysis, risk assessment, negotiation, and an understanding of aviation regulations and market trends.

What is the difference between aircraft leasing and financing?

What are the biggest challenges facing the aircraft finance industry? Challenges facing the aircraft finance industry include economic downturns, airline bankruptcies, and changes in aviation regulations and market trends. Additionally, environmental concerns related to aircraft emissions are becoming an increasingly important issue.

How can I stay up-to-date with the latest developments in the Aviation Industry?

What are the biggest opportunities in aircraft finance? The biggest opportunities in aircraft finance include growth in emerging markets, the increasing demand for leased aircraft, and the development of new financing structures and products.

How can I spend time preparing for a job alert in aircraft finance?

Preparing for a career in aircraft finance involves gaining relevant experience in finance or aviation, developing the necessary skills and qualifications, and networking with others in the industry. Additionally, obtaining relevant certifications, such as those offered by the International Society of Transport Aircraft Trading (ISTAT), can be beneficial.

Our Final Thoughts

We have covered several topics related to working in the aircraft finance sector, such as the roles and responsibilities of various positions within a lessor, business activities of a lessor, and FAQs for mid-level aerospace workers looking to enter the aircraft finance sector.

However, there are still other topics that could be relevant to someone looking to work in this field, such as:

Industry regulations and compliance:

It’s important for those in the aircraft finance sector to have a solid understanding of regulations and compliance standards, such as those set by the Federal Aviation Administration (FAA) and International Civil Aviation Organization (ICAO).

Market trends and analysis:

A thorough understanding of market trends and analysis is essential in aircraft finance, as it can help lessors stay ahead of the competition and make informed decisions about buying, selling, and leasing aircraft.

Aircraft maintenance and repair of New technologies:

Technical roles within aircraft leasing financing may also involve overseeing or participating in aircraft maintenance and repair activities of composite materials, new electric propulsion engines and SAF (sustainable aviation fuel).

Environmental considerations:

As the aviation industry works to reduce its carbon footprint, lessors may need to consider factors such as sustainable aviation fuels, electric aircraft, and other environmentally friendly initiatives.

Risk management:

Mitigating risk is an important part of any financial sector, and aircraft leasing is no exception. Those working in this field may need to have a deep understanding of risk management strategies and be able to assess potential risks associated with various leasing arrangements.