Due Diligence is a life skill - Here's why

Due diligence is the systematic process of making sure the I’s are dotted and T’s crossed. To verify that what you have is legitimate and there are no secrets or omissions

In aviation, lots of deals are done with the assets sold “as-is-where-is”. So, if you don’t review everything before you buy – it could come back to haunt you.

You or your team need to be Due Diligence Ninjas.

Aviation Businesses

Do you have any idea the number of due diligence areas that can catch the unwary buyer? You don’t! Great, we’re going to fix that right now.

We are going to give you a crash course in how aircraft and engine due diligence best practices should be done right.

Aircraft Leasing Company

Aircraft leasing is simple. Investors and financiers look at the airline credit, the deal returns and the risks that the deal will reach maturity. But the more prestigious the airline, the more competitive the deals. And the leaner the returns, the greater the need for your business transactions to go without a hitch. For years.

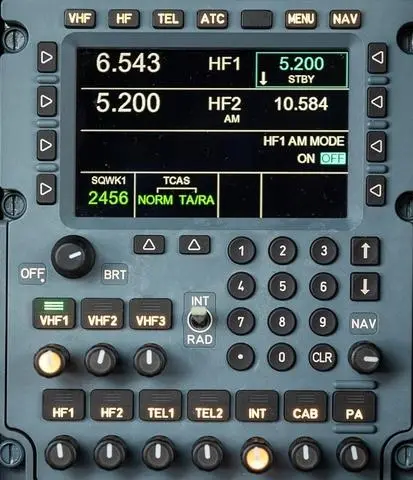

Everyone in the Aerospace field will face the DD process at some stage. Your airline takes delivery of a new aircraft, or a used one. Your MRO is doing a check on an aircraft in transition, or you are working for the technical services group contracted for a pre-purchase inspection.

It’s all the same activities. You are being tasked to perform due diligence on metal and its related paperwork.

Aircraft is Property

Here’s how we would do it. Broken into Key Areas with due diligence investigation points and questions that will impact your decisions.

Let’s imagine a deal. The Bank has approved the finance and the airline has made its decision to take your aircraft. That’s just the financial and legal elements. Your board is not going to sign off until the other five areas of due diligence audits are performed to an acceptable level of satisfaction. These due diligence report areas are;

Commercial

Airline

Jurisdiction

Asset

Technical

Commercial

Diligence Checklists

Getting to the right market at the right time, and in the right part of the aviation cycle is central to the acquisition and investment strategy for any airline. Knowing these areas is critical practice for investors or banks. Because it forms part of their Risk.

In effect, you are validating what the airline is telling you – that the passengers exist, and that the airline market strategy is robust. And their financial projections are accurate.

Diligence Report Types

Here are those Airline projections that need your diligence attention.

1. Market Growth estimates – Are they realistic? Do they match the lease rates and MR (maintenance reserve) burden on the airline? What is their competition doing?

2. What is their Strategy? – Is it clear? Has it been stress-tested? Are they low-cost, or ultra-low cost? Low-cost long haul? Business class on thin routes? What exactly is their business activity?

4. The Competition – What is it doing? Or not doing. Are they missing a trick? On the product or its delivery? Should you take a cue from their inability to ignite a bad market?

Airline Diligence Example

Does the bank really know the airline? And the management team? Does the airline know their national authority? Do they know the business relationships between the airline and their providers?

Investors rarely have this deeper insight – but they need to. They need to verify the impact of things like.

1. The Money – Who are their backers? A fund, the Country/state, or maybe a High-Net-Worth individuals. Do these folks know the aviation market? Do they have experience?

2. Track Record – How has the airline been performing? Especially areas like load factor, efficiency profitability, and liquidity. Some Airlines tend to be highly seasonal or have exposure to exchange rate issues.

3. Strategy Execution – On paper, it might say Low-cost carrier, but the management might have pivoted recently or failed to execute and now operate a mix of regional feeder services and high-season charters. Are these red flags?

4. Who’s in charge? – the CEO? Or the wealthy founder/chairman? Could the real boss be a national airline they operate franchise flights for? And is he a reasonable person capable of making sound decisions?

5. What’s their reputation like? – Put some feelers out in the community to see what the other lessors are saying about their business relationships? Listen to those who have taken aircraft back from this carrier. How was that handled? Did they deliver on the lease-end terms? Were they professional?

Diligence Meaning

Where are they based? Where do they operate to and from? And who is overseeing their regulatory compliance and performance? Linked to commercial market activity is the economic performance of that area, political stability, and potential interference by the state, but most important is the legal framework when it comes to disputes, property repossessions, and the Cape Town treaty.

1. Airlines are still regarded as economic leaders, especially in situations when they are either growing or recovering from a recent downturn. Countries invest and support airlines as they act as both a driver and mascot for development. But be careful of excess effort in this area. Brazil and India being countries where growth outstrips infrastructure in boom times.

2. Political Stability. In Early 2022 Russia invaded Ukraine. So, the EU applied sanctions. This affected the 700 leased aircraft with Russian carriers. The response by Russia? Just re-register them in Russia and let’s keep flying. This contravenes all known international laws and treaties and is still unfolding. but the liability story will go on for years. History is an effective way of seeing which countries act appropriately when times are tough.

Asset Diligence Check

The asset is both the aircraft and the engines, as some aircraft types offer choices. But here let’s keep it simple and just say the Aircraft. A lessor or investor’s first choice is the type of aircraft it wants to own.

Years ago, most investors would just perform a sale-leaseback (SLB) with the airline credit being the main driver of targeted capital, but these days Lessors buy directly from Boeing and Airbus. And they keep their shopping list simple.

Airplanes People

This means the B737 or A320. Lessors might dip their toes into A321s or even B787s or A350. Or the gamey ones will look at dedicated freighters like the A330F and the B777F. But the B737 and the A320 are the Toyota Corollas /VW Golfs of the skies. And it means the operator base is nice and large, should you need to remarket the aircraft quickly.

A good example is the Airbus A380. When that aircraft was doomed, it was doomed partly because the secondary market simply didn’t exist. It didn’t matter how good the aircraft was on certain routes, or in a certain configuration, if the customer base of operators was zero.

1. The best investment – Turboprops are good. Some older Widebodies. You might say B737, but the returns are criminally low because the market is crowded. Widebodies returns are stupendous, but you better say your prayers at night and hope you don’t get any nasty surprises.

2. Advisors – Asset DD is where you really need an advisor. They can look at the type and engine combination across that market and use data from many years. They can look at hours and cycles and performance of all airlines since Kitty Hawk in 1917 and tell you what requisite effort you can expect. Even if it’s only a guesstimate – it’s the best thing you will do.

3. Utilization – How the aircraft is operated and what routes and “cycle to hour ratio” are important. An ATR72-600 flying from Nantes to Paris twice a day will be a nice polite, balanced operation in line with the maintenance schedule and engine operational limitations. But that same aircraft flying ten sectors a day around the salty air of the Solomon Islands, or from Dubai to Bahrain will need a lot more maintenance care due to a saline and sandy environment.

Technical Property

Very much connected to the Asset DD is the Technical DD. It is the actual condition of the aircraft as represented by its physical condition and paperwork at any given time. Why is this important? Because two B737s of the same age and total hours can have a value delta as wide as 75%. Depending on whether the aircraft is due a major check (C-check) or if the engines need a full performance restoration.

If you are an investor, then this is 100% where you need to outsource to a technical person or group who will save you from costly mistakes.

1. Physical inspections – Is the aircraft in the condition as stated? The delta between “as stated” and various dents, missing items, AD’s not done, and corrosion could run into the millions.

2. Storage and Maintenance history – Make sure all the aircraft history is consistent and there are no gaps in approved storage programs. If there is, you are in big trouble and might need to perform major surgery.

3. Records – Tied to the storage issue and this is the critical area. An aircraft (or part) with missing or even incomplete paperwork is worthless. Repeat – Worthless. If it doesn’t exist or you’ve been promised it later – walk away. Paperwork is also a great indication of the type of seller or operator you’re dealing with.

So, buyer beware. And do your due diligence. It’s important. Or your Corporate Strategy will be doomed.