Environment, Sustainability and Governance

Environmental – Social – Governance (or ESG) could be the best development in corporate history. We in aviation certainly know the E given our C02 woes.

But the other two are just as important to our survival. Especially in the next, critical, 20 years.

ESG is present in all investment sectors. Rightfully so. We sometimes call ESG – “Energy, Society, and Good behavior”. If you use energy, sell to society, or want to root out corporate or fiscal, then you need to embrace ESG. Or at least understand it from an investment point of view.

ESG & The Green Investor

And if you can put a couple of ESG arrows in your quiver. That’s good for everyone, as well as your career. Aviation is a capital-intensive investing business. A new B737Max will run you over $100m. And the people who lend you the money to buy it are really focused on your ESG and social performance.

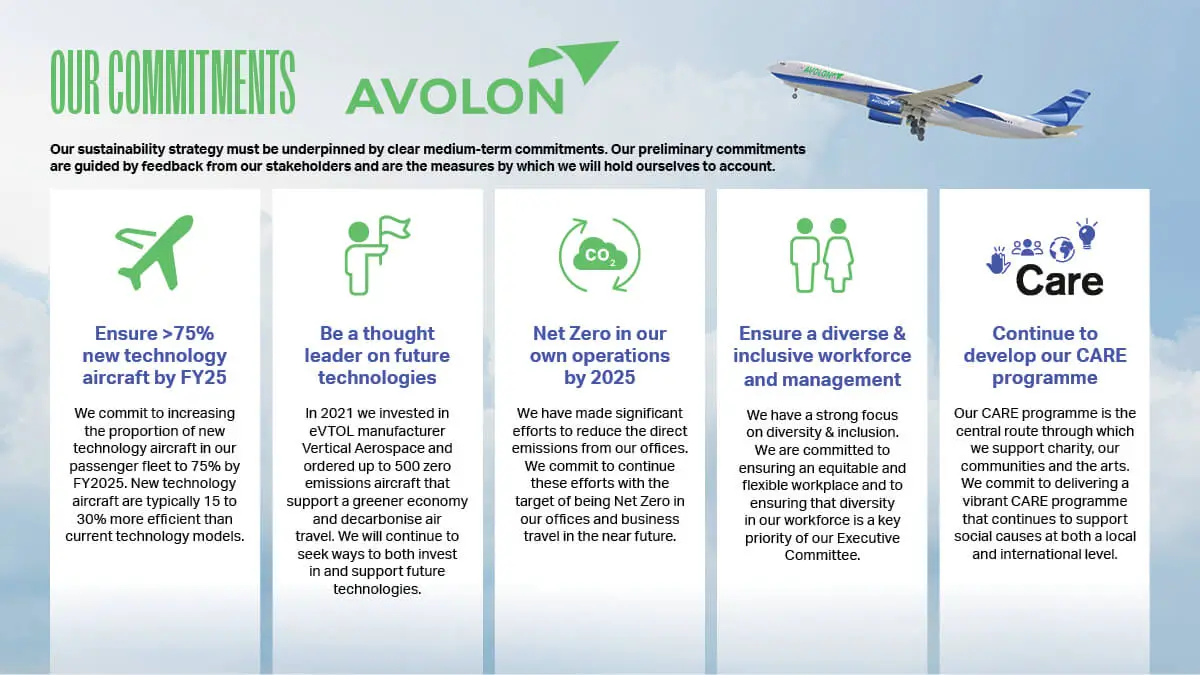

ESG and sustainable investing are also under the investor spotlight. All financial institutions now rank their ESG investment choices as their top priority. In Aviation, we have GREEN LEASING where we need to show solid improvements in previous CO2 performances as well as social and governance.

Risk

ESG is a new category, but all ESG investing categories have been around forever. They were just combined by the investment industry in 2005 when they realized that individual investors cared passionately about how their investment funds and financial markets were behaving.

Investor Risk was then brought into the equation. Some wealthy mutual funds donated to charities through one arm, but funding asset companies that destroyed forests or helped oligarchs hide billions with another. But don’t worry, ESG is how we will stop them.

ESG - Investment

What does it mean for me? You might ask.

A lot.

ESG is already impacting your company and your job whether you are an investor or not. We hope you care already, but at the end of this article, you should care. This is an aviation career site but don’t fret, the ESG concepts here are standard and therefore a good jumping-off point for any asset sector.

Regardless of the market. We also have courses and responsible investing resource suggestions that are internationally recognized. Regardless of which side of the investment process you are on.

E = Environmental Times

This is the main focus of Aviation. Fuel. Or CO2 emissions if you want to cut to the chase. We have a #Flynetzero goal being headed by IATA. The pledge is to be carbon neutral by 2050. With over 25,000 aircraft flying around the world, and 40,000 by that year, it is a biblical asset task. But we are already on the road to success. We have been for one hundred years.

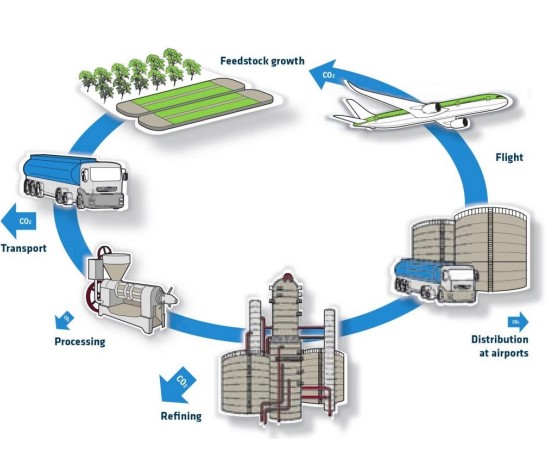

Improvements in aircraft and propulsion design are non-stop but the mountain we need to cross is the source of our energy. The best areas right now are SAF (sustainable aviation fuel) Hydrogen and Electric power. You can read more about these in our article. But hold your jets folks, Aviation is a complex investment decision-making process.

Gains made on engine efficiency can be lost by Air Traffic Control, taxiing problems at busy airports, or wrong procedures by the crew. And the governance factors around these elements are not easily changed.

Here is a look at the fuel projections by IATA under a banner called WAYPOINT 50 and how these three should get us to where we need to be. But it needs a holistic supply chain solution.

What is Sustainable ESG Investing?

Here are the broad range of energy categories where these solutions will work given known technologies.

SAF – This is our best bet because it is what we call a “drop-in” fuel. A fuel that we can just drop into the current infrastructure used by JetA1. So is the least disruptive. It is also the closest in terms of time. The issue is feedstock and production and not risk tolerance.

Electric – Electric power only works on small aircraft over short distances. By short we mean a couple of hundred miles with a dozen people or less. We hope that changes – we really do. But the issue is battery weight. For example, as an aircraft burns fuel, the aircraft gets lighter. This doesn’t happen with battery-powered aircraft. And we have looked at the potential leaps in battery tech – it won’t get us where we need to be, especially on medium and long-haul where most of the CO2 problems lie. We need battery investing and investor groups asap.

Hydrogen – This is the most exciting market area as a lot of energy can be obtained from a small amount of liquid Hydrogen. But it is still more voluminous than kerosene and must be kept at -253 degrees C. In the short term, we can use it to produce SAF and, down the road, we hope to develop Hydrogen combustion engines. It’s just that Hydrogen is incredibly challenging for the aviation market to work with.

Responsible Investing

So, for our engineers, designers, and aerodynamicists, the goals are clear. We need to do it all. And we need to continually improve the technology we already have.

Only with all these things can we get to where we need to go. For everyone else, we suggest you read the analysis in this REPORT here where the full gamut of Aviation Fuel concepts is well drawn. There is a good section on the high-altitude environmental issues around the dispersion of gases in contrails. And how investing might tackle this.

S = Social Investing

The social criteria considerations are as follows.

- Gender Equality

- Societal inequalities

- Decent work in a decent, responsible industry

- Clean energy and its responsible consumption

- Climate action at all levels

Social and Governance

The progress of women in aviation is not good, especially in some parts of the world. It is improving however, and we need woman to head impact investing in sectors where they are accurately represented. I am a man and I have seen firsthand both toxic masculinity and kindness in a male-dominated sector. Many years ago, it was normal for a country’s military to bring staff and experience to the fledgling commercial operators.

And our outdated governance issues would be influenced or developed by these same people. Thankfully, that’s long gone. Now, we have several great female-led aviation organizations aware of environmental risks. Here are the notable ones as well as some other Social related sites that we like and feel you should be part of.

G = Good Governance

ESG reporting and financial reporting are what this means. It’s how most organizations are viewed and ranked. And how we can keep an eye on them or reward them. What’s not really spoken about in aviation circles is that aviation investing has become somewhat of a problem for investors, and some downplay their involvement or are getting out of the sector.

This is a mistake. Aviation is 3% of global C02 emissions and our power to weight ratio is by far the lowest. Aviation is also the “Physical Internet” with the power to connect people, businesses, goods, and tourism. We don’t point fingers on this site, but we do ask that you understand the whole Carbon story. We all have a job to do, so let’s get on with it.

Responsible ESG Investments

If you need to learn more about investing or investment strategy side in other sectors – we ask that you visit these organizations.

Wingtalkers is the central hub for all things related to Aviation and aerospace career resources. Find out about these roles here.